Money

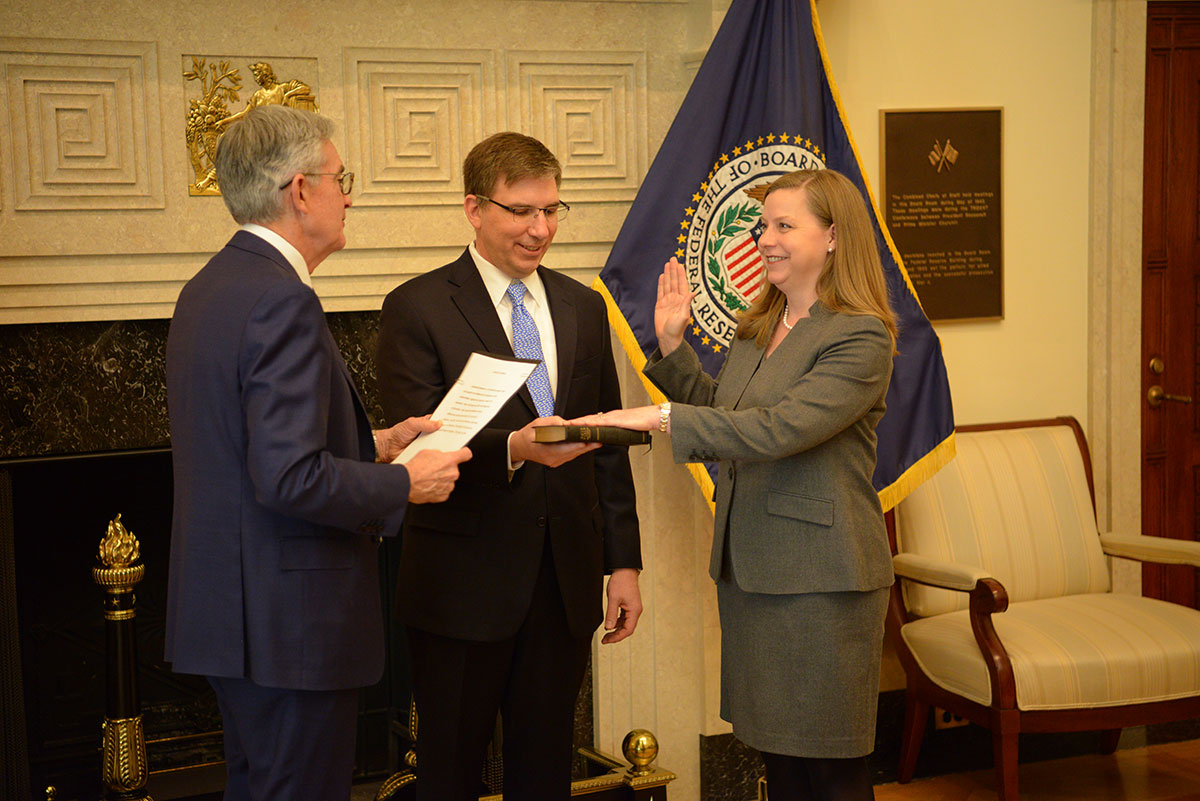

Fed Reserve Governor Michelle W. Bowman: The Changing Structure of Mortgage Markets and Financial Stability

Fed Reserve Governor Michelle W. Bowman: The Changing Structure of Mortgage Markets and Financial Stability

"I will begin today by describing the evolving role of mortgage companies in mortgage markets and the risks to financial stability that activity entails. I will then focus on developments in mortgage markets during the COVID-19 pandemic and discuss how actions by the Federal Reserve and the other parts of the government helped stabilize financial markets and prevent more severe damage to the economy. Finally, I will explain how vulnerabilities associated with mortgage companies could pose risks in the future, and I will review ongoing work across the regulatory agencies to monitor and address these vulnerabilities. I will end by enlisting your help. Figuring out how to achieve a balanced mortgage system — one that delivers the best outcomes for consumers while being sufficiently resilient — is a highly complex task that could benefit from the insights of those of you here today." more »

Updated Subsidy Calculator and 300+ FAQs Help Consumers Understand the ACA Marketplaces as Open Enrollment Begins

Updated Subsidy Calculator and 300+ FAQs Help Consumers Understand the ACA Marketplaces as Open Enrollment Begins

Ahead of the annual Affordable Care Act (ACA) open enrollment period, the time during which consumers can shop for health plans or renew existing coverage, KFF has updated its Health Insurance Marketplace Calculator and its searchable collection of more than 300 Frequently Asked Questions about open enrollment, the health insurance marketplaces and the ACA. KFF’s Health Insurance Marketplace Calculator provides estimates of 2021 health insurance premiums and subsidies for people purchasing insurance on their own in health insurance exchanges. Users can enter age, income, and family size information to estimate their eligibility for subsidies and how much they can expect to spend on health insurance. more »

Chair Jerome H. Powell: A Current Assessment of the Response to the Economic Fallout of this Historic Event

Chair Jerome H. Powell: A Current Assessment of the Response to the Economic Fallout of this Historic Event

Payrolls have now recovered roughly half of the 22 million decline. After rising to 14.7 percent in April, the unemployment rate is back to 7.9 percent ... A broader measure that better captures current labor market conditions — by adjusting for mistaken characterizations of job status, and for the decline in labor force participation since February — is running around 11 percent...The initial job losses fell most heavily on lower-wage workers in service industries facing the public — job categories in which minorities and women are overrepresented... Combined with the disproportionate effects of COVID on communities of color, and the overwhelming burden of childcare during quarantine and distance learning, which has fallen mostly on women, the pandemic is further widening divides in wealth and economic mobility. more »

Federal Reserve: Optimism in the Time of COVID; Businesses Seem Much Better Adapted to Remaining Open

Federal Reserve: Optimism in the Time of COVID; Businesses Seem Much Better Adapted to Remaining Open

Turning now to the labor market, unemployment was still at 8.4 percent in August and the labor force participation rate still down significantly from February. The extraordinary package of fiscal support in the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) helped to support household incomes and to offset the effect of the huge job losses in March and April. But the act's unemployment provisions have expired, and most of the businesses that received Paycheck Protection Program (PPP) loans report that they have exhausted those funds.4 In addition, one area where increased understanding of the disease has, in many places, not led to general changes in practice is in the widespread school closures this fall. Many parents with children will be forced to work less, or not at all, which is going to be a hardship for them and weigh on the economy. So, I agree with Chair Powell that it will take continued support to sustain a robust recovery. more »