Employment Links

Jo Freeman Reviews: When the News Broke: Chicago 1968 and the Polarizing of America

Jo Freeman Reviews: When the News Broke: Chicago 1968 and the Polarizing of America

Jo Freeman Reviews: "In 1968, change was happening all over the world. In the US, mounting opposition to the war in Viet Nam and several burgeoning social movements all demanded attention. People representing many of these came to the 1968 Democratic Convention in Chicago in hopes of reaching the larger public with their message. Heather Hendershot writes about the news media – especially the three network TV companies – at the 1968 Democratic Convention in Chicago. What would the news networks cover?" more »

Women's Congressional Policy Institute, Bills Introduced: Child Assistance Program, Men's and Women's Fairness in College Sports

Women's Congressional Policy Institute, Bills Introduced: Child Assistance Program, Men's and Women's Fairness in College Sports

A bill to establish a universal child assistance program, and for other purposes. A bill to establish a Commission on Men's and Women's Fairness in College Sports; A bill to permit leave to care for an adult child, grandchild, or grandparent who has a serious health condition.

Bringing women policymakers together across party lines to advance

issues of importance to women and their families.… more »

Ferida Wolff's Backyard, A Natural Path

Ferida Wolff's Backyard, A Natural Path

Ferida Wolff Writes: "I find this activity so simple and calming that I like to do it often during the nice weather. And each season nature invites us to share in the changes, to see the variety that exists naturally. I hope that everyone has access to a calming place, a space to take a deep breath and let go of any worries... An awareness of the natural connection can beautifully enhance our lives." more »

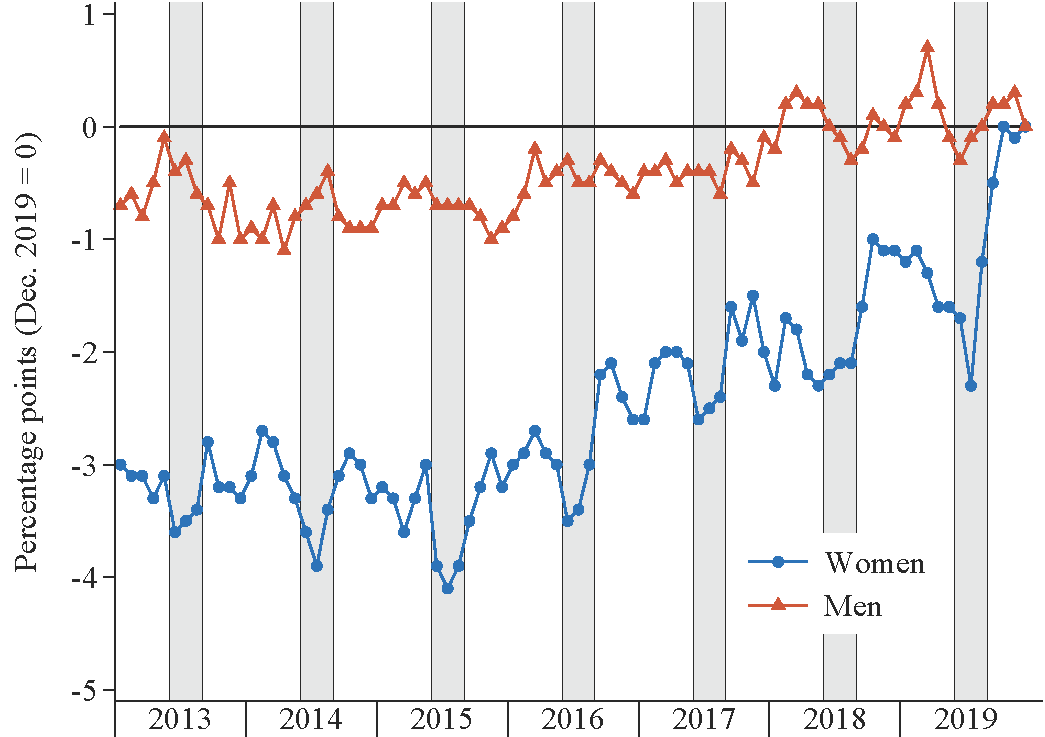

Federal Reserve Notes: Gender Gaps in the Labor Market Widen Every Summer Contributing to Gender Disparities in Promotions and Pay

Federal Reserve Notes: Gender Gaps in the Labor Market Widen Every Summer Contributing to Gender Disparities in Promotions and Pay

"Gender gaps in labor market activity are pervasive, longstanding, and a regular subject of policy debates. Relative to men, women tend to work fewer hours per week, more conventional hours, and fewer years over the course of their lives. These differences in the intensity and timing of work contribute to gender disparities in promotions and pay. But despite decades of research on this topic, little attention has been paid to the timing of work throughout the year. To motivate our inquiry, Figure 1 plots the monthly labor force participation rates of prime-age US women and men using non–seasonally adjusted data, with June, July, and August shaded gray. Summer after summer, women's labor force participation drops sharply while men's participation does not." more »